FSSAI Annual Return Filing Online | File Form D1 & D2 Easily

Every Food Business Operator (FBO) in India — whether a manufacturer, importer, distributor, or dairy unit — must submit their FSSAI Annual Return Filing Online before the 31st May 2025 deadline. Filing your Form D1 and D2 returns on time is crucial to stay compliant with the Food Safety and Standards Authority of India (FSSAI) and to avoid hefty penalties.

At MyFoodExpert, we make the entire FSSAI Return Filing process fast, seamless, and affordable. Our compliance professionals ensure your data is accurately submitted, your documentation is verified, and your FSSAI license remains valid without any last-minute stress.

FSSAI Registration & Annual Return – What Every Food Business Must Know

FSSAI Registration and Annual Return Filing are mandatory compliance requirements for all food business operators (FBOs) in India, ensuring complete adherence to food safety regulations. Whether you operate a restaurant, food processing unit, online food delivery service, catering business, or packaged food brand, obtaining FSSAI registration or license is essential to legally run your operations. The FSSAI license not only validates that your business meets national food safety standards but also enables you to apply for government schemes, open current bank accounts, and expand your food business legally. Submitting FSSAI Annual Returns is crucial to maintain ongoing compliance, provide transparency in sourcing, manufacturing, and distribution, and avoid penalties, fines, or license suspension. By ensuring your food operations are fully compliant, FSSAI Registration and Annual Return Filing protect consumers, build trust, and support sustainable business growth, making it an indispensable requirement for every food business in India.

Key Purpose of FSSAI Annual & Half-Yearly Return Filing for Food Businesses in India

The key purpose of FSSAI Annual and Half-Yearly Return Filing is to ensure that all food business operators (FBOs) in India remain fully compliant with food safety regulations and maintain transparent, safe, and standardized operations. By submitting these returns, FSSAI can monitor sourcing, manufacturing, storage, and distribution of food products, both domestically and internationally, creating a national database of food businesses. This process helps control unsafe or non-compliant practices, facilitates efficient planning of inspections and audits, and ensures adherence to FSSAI rules, regulations, and food safety standards. Ultimately, regular return filing protects consumers, builds trust in your brand, avoids penalties or license suspension, and supports sustainable growth for your food business in India.

What is FSSAI Annual & Half-Yearly Return Filing?

FSSAI Annual and Half-Yearly Return Filing is a mandatory compliance process for all food business operators (FBOs) in India, designed to ensure that every aspect of food handling adheres to food safety regulations under the Food Safety and Standards Act, 2006. These returns require businesses to report detailed information about sourcing, manufacturing, processing, storage, and distribution of food products to the Food Safety and Standards Authority of India (FSSAI).

The filing process serves multiple purposes: it monitors domestic and international food trade, maintains a national database of registered food businesses, and allows authorities to identify and minimize unsafe or non-compliant practices. By submitting Annual and Half-Yearly Returns, food businesses not only comply with legal requirements but also demonstrate transparency, accountability, and commitment to food safety.

Filing these returns is essential for all types of food businesses, including restaurants, food manufacturers, packaged food brands, caterers, cloud kitchens, and importers/exporters of food products. Non-compliance can result in penalties, fines, or suspension of FSSAI licenses, making it a critical part of maintaining legal operations and consumer trust.

Why is FSSAI Annual & Half-Yearly Return Filing Important for Food Businesses in India

FSSAI Annual and Half-Yearly Return Filing is a critical compliance requirement for all food business operators (FBOs) across India. Filing these returns ensures that your food operations are fully aligned with FSSAI regulations and food safety standards, protecting both your business and your consumers.

Key Reasons Why FSSAI Return Filing is Important

- Ensures Compliance with Food Safety Regulations

Filing FSSAI Annual and Half-Yearly Returns allows authorities to monitor your food operations, including sourcing, manufacturing, storage, and distribution processes, ensuring that your business meets the Food Safety and Standards Act, 2006 - Maintains Transparency in Food Operations

FSSAI return filing mandates detailed reporting of all activities, making your food business operations completely transparent. This transparency is essential for regulatory audits, inspections, and certification processes. - Prevents Non-Compliance and Penalties

Non-submission or late filing of FSSAI returns can lead to strict penalties, fines, or license suspension. Regular filing demonstrates your commitment to food safety and legal compliance, safeguarding your business from legal risks. - Supports Better Planning for Inspections

By submitting Annual and Half-Yearly Returns, FSSAI can maintain an updated national database of food businesses, which helps in efficient planning of inspections, monitoring unsafe practices, and issuing regulatory updates. - Enables Market Expansion & International Trade Compliance

Proper return filing ensures that imported and exported food products meet safety standards, supporting global trade compliance and expanding your business reach both domestically and internationally.

For every food business in India, FSSAI Annual and Half-Yearly Return Filing is not just a legal formality—it is a strategic tool for compliance, transparency, and growth. Regular return submission helps avoid penalties, build consumer trust, and ensure operational excellence, making it an indispensable part of FSSAI compliance.

Who Needs to File FSSAI Annual & Half-Yearly Return in India

FSSAI Annual and Half-Yearly Return Filing is mandatory for all food business operators (FBOs) in India, but understanding who exactly must comply is essential to avoid penalties and maintain full FSSAI compliance.

Food Businesses Required to File FSSAI Returns

Restaurants, Cafes, and Food Delivery Services

All restaurants, cafes, cloud kitchens, and online food delivery platforms must file FSSAI Annual and Half-Yearly Returns to ensure their food preparation, storage, and delivery practices meet national food safety standards.Food Manufacturing Units and Processors

Businesses involved in food processing, packaging, and manufacturing are required to submit returns detailing raw material sourcing, production processes, and product distribution to demonstrate regulatory compliance.Caterers, Event Food Services, and Mobile Food Vendors

Any catering service, event food provider, or mobile food vendor operating in India must file returns to maintain transparency in operations and comply with FSSAI food safety guidelines.Importers and Exporters of Food Products

Companies engaged in importing or exporting food items must submit FSSAI returns to ensure that all domestic and international food shipments comply with safety and regulatory standards.Packaged Food Brands and Retail Food Businesses

Packaged food companies, supermarkets, and retail food outlets must file FSSAI Annual and Half-Yearly Returns to demonstrate adherence to food labeling, packaging, and safety regulations.

Type of Food Business | Form Type | Frequency | Mode of Filing |

Food Manufacturer / Processor | Form D1 | Annual | Online |

Food Importer | Form D1 | Annual | Online |

Dairy Unit (Milk & Milk Products) | Form D2 | Half-Yearly | Online |

Distributor / Retailer | Depends on license type | Annual | Online |

If you are unsure which category your business falls under, Consult MyFoodExpert’s professional FSSAI license return filing consultant in India for expert guidance.

Why Compliance Matters

Failing to file FSSAI Annual or Half-Yearly Returns can result in legal penalties, fines, or even license cancellation. Regular return filing ensures that your food business operations remain transparent, compliant, and ready for inspections, while also enhancing consumer trust and business credibility.

Benefits of Filing FSSAI Annual & Half-Yearly Returns for Food Businesses in India

Filing FSSAI Annual and Half-Yearly Returns is not just a legal formality—it is a strategic compliance requirement that offers numerous advantages for all food business operators (FBOs) in India. Regular return submission ensures that your food operations are fully compliant with FSSAI regulations, maintains transparency, and strengthens consumer trust.

Benefits of FSSAI Return Filing

✔ Ensures Legal Compliance

Timely filing of FSSAI Annual and Half-Yearly Returns helps businesses stay compliant with the Food Safety and Standards Act, 2006, avoiding fines, penalties, or license suspension.

✔ Enhances Consumer Trust & Brand Credibility

By maintaining transparent sourcing, production, and distribution processes, food businesses demonstrate their commitment to food safety, building consumer confidence and brand reputation.

✔ Facilitates Operational Transparency

Filing returns requires detailed reporting of all supply chain activities, enabling authorities to monitor, audit, and assess business operations effectively.

✔ Supports Regulatory Oversight & Inspections

Submitting returns contributes to a national database of food businesses, helping FSSAI plan inspections, update regulations, and minimize unsafe or non-compliant practices.

✔ Enables Business Growth & Market Expansion

Proper return filing ensures that businesses engaged in domestic trade, imports, or exports comply with all safety standards, facilitating market expansion and international trade opportunities.

✔ Prevents Food Safety Risks

Regular monitoring through return filings helps identify non-compliance or unsafe practices early, ensuring high-quality food products for consumers.

Eligibility Criteria for Filing FSSAI Returns in India

The Eligibility Criteria for Filing FSSAI Returns are clearly defined under the Food Safety and Standards (Licensing and Registration of Food Businesses) Regulations, 2011. Every Food Business Operator (FBO) in India, holding an FSSAI License, must comply with these requirements to ensure legal operation and food safety compliance. Whether your business involves manufacturing, processing, storage, distribution, import, export, or retailing of food products, filing FSSAI Annual and Half-Yearly Returns is mandatory.

Who is Eligible (and Required) to File FSSAI Returns?

FBOs Holding FSSAI License (Not Registration)

Only food businesses possessing a State or Central FSSAI License are required to file Annual and Half-Yearly Returns. FBOs with a Basic FSSAI Registration are exempt from this requirement.Manufacturers, Packers, and Processors of Food Products

Businesses involved in food production, packaging, or processing must submit details of product categories, production volumes, and distribution channels through FSSAI return filing.Importers and Exporters of Food Products

All importers and exporters dealing with food commodities are required to file Form D-1 and Form D-2 returns, providing data about imported or exported food items, sources, and destinations.Distributors, Wholesalers, and Retail Food Outlets

Entities engaged in wholesale distribution, retail operations, or food storage must file FSSAI returns to maintain transparency in the food supply chain.Caterers, Cloud Kitchens, and Food Delivery Operators

All catering services, event food providers, cloud kitchens, and online food delivery platforms operating under an FSSAI license are required to comply with return filing obligations to remain legally operational.

Why Meeting FSSAI Eligibility is Important

Meeting the FSSAI Return Filing eligibility criteria ensures your business maintains operational transparency, avoids penalties, and remains compliant with national food safety regulations. Non-compliance may lead to fines, legal notices, or suspension of FSSAI license, which can directly impact your business credibility and growth.

Information Required to File FSSAI Annual Return (Form D1)

Filing the FSSAI Annual Return (Form D1) is a mandatory compliance requirement for all licensed Food Business Operators (FBOs) engaged in manufacturing, processing, packing, or importing food products in India. This return, submitted annually to the Food Safety and Standards Authority of India (FSSAI), ensures that every food business maintains transparency, traceability, and legal compliance under the Food Safety and Standards Act, 2006.

To successfully complete your FSSAI Annual Return (Form D1), you must provide accurate and detailed business information as specified by the authority.

Essential Information Required for Filing FSSAI Annual Return (Form D1)

- Name and Address of the Food Business Operator (FBO)

The registered business name and operational address as mentioned in the FSSAI License Certificate. - FSSAI License Number

The 14-digit FSSAI license number, which serves as a unique identification code for the food business. - Details of Food Products Handled

A complete list of food products manufactured, processed, imported, or exported, along with their HSN codes, product types, and categories. - Quantity of Each Food Product

The total quantity of each product handled during the financial year, including manufactured, sold, imported, and exported quantities. - Value of Each Food Product

The monetary value of food products produced, sold, or traded, as per the official business records. - Details of Packaging Material Used

Information regarding the types of packaging materials used (e.g., plastic, metal, glass, paper, or biodegradable materials), ensuring compliance with FSSAI packaging regulations. - Sources of Raw Materials and Ingredients

Disclosure of suppliers, vendors, and sourcing regions to maintain traceability and quality assurance. - Distribution and Supply Chain Information

Details of distribution channels, warehouse locations, wholesalers, and retailers associated with your food products. - Details of Imported or Exported Food Products (if applicable)

For importers/exporters, mention the countries of import/export, port details, and product descriptions. - Date and Signature of Authorized Signatory

The signature, designation, and contact details of the authorized person filing the return.

Information Required to File FSSAI Half-Yearly Return (Form D2)

The FSSAI Half-Yearly Return (Form D2) is a mandatory compliance requirement for all Food Business Operators (FBOs) involved in the manufacture, import, or export of milk and milk products in India. This return must be submitted twice a year to the Food Safety and Standards Authority of India (FSSAI) to ensure transparency, traceability, and adherence to food safety standards under the Food Safety and Standards Act, 2006.

Filing Form D2 provides FSSAI with accurate data on milk handling operations, helping authorities regulate and maintain food quality, hygiene, and consumer safety across the dairy industry.

Essential Information Required for Filing FSSAI Half-Yearly Return (Form D2)

- Name and Address of the Food Business Operator (FBO)

The legal business name, factory location, and registered address as stated on the FSSAI License Certificate. - FSSAI License Number

The 14-digit FSSAI license number, which uniquely identifies your business under the FSSAI compliance framework. - Details of Milk and Milk Products Handled

Comprehensive data about types of milk and milk products manufactured, processed, imported, or exported — such as pasteurized milk, cream, ghee, butter, cheese, curd, milk powder, etc. - Quantity of Each Milk Product

The total quantity (in kilograms or liters) of each milk or dairy product handled during the half-year period, ensuring transparent reporting. - Quantity and Source of Milk Procured

Information on the total milk collected from different sources — including cooperatives, farmers, local vendors, or imported stock — along with their geographical locations. - Details of Milk Products Sold or Distributed

Data on domestic sales, exports, and distribution channels, including warehouses, retailers, wholesalers, and export destinations. - Value of Milk and Milk Products

The market value or turnover for each category of milk and dairy product handled during the reporting period. - Details of Imported or Exported Milk Products (if applicable)

For importers or exporters, details about import/export countries, port of shipment, batch numbers, and product descriptions must be furnished. - Date and Signature of Authorized Signatory

The signature, designation, and contact details of the authorized individual responsible for filing the return.

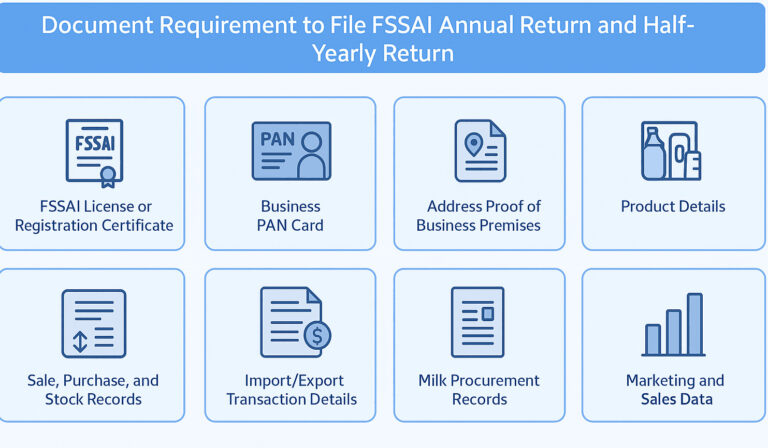

Documents Required for FSSAI Annual & Half-Yearly Return Filing in India

Filing FSSAI Annual and Half-Yearly Returns is a crucial step in maintaining your food business compliance under the Food Safety and Standards Authority of India (FSSAI). To ensure seamless filing and avoid penalties, every Food Business Operator (FBO) must keep the required FSSAI return documents ready and updated. These documents help FSSAI verify your food operations, product details, and adherence to food safety standards.

Below is the list of mandatory documents required for FSSAI Annual Return (Form D1) and Half-Yearly Return (Form D2) filing:

Documents Required for FSSAI Annual Return (Form D1):

- FSSAI License / Registration Certificate – Proof of valid food business operation under FSSAI guidelines.

- List of Food Products Manufactured or Handled – Includes product names, categories, and safety classifications.

- Quantity of Each Product Sold – Monthly or annual quantity details in metric tons or kilograms.

- Invoice Summary / Sales Data – Detailed record of domestic and export sales.

- Details of Packaging Type and Sizes – Information on packaging used for each product category.

- Country of Export (if applicable) – For exporters, details of countries where products are shipped.

- HS Code of Exported Products – Helps classify goods as per international trade norms.

- Storage & Processing Details – Addresses of manufacturing, storage, and distribution units.

Documents Required for FSSAI Half-Yearly Return (Form D2):

(Applicable to FBOs involved in import/export of milk, milk products, or other perishable goods)

- FSSAI License Copy (Import/Manufacturing/Distribution)

- Details of Milk or Milk Products Handled – Type of milk, fat content, and SNF percentage.

- Quantity of Products Handled (Monthly Basis) – Total volume procured, produced, and sold during the half-year.

- Source of Milk Procurement – Dairy units, cooperative societies, or direct suppliers.

- Distribution Channels – Details of end users, distributors, or export partners.

- Testing and Quality Reports (if applicable) – Laboratory reports ensuring product quality and safety compliance.

- Supporting Sales Invoices or Transaction Statements – For verification of sale and supply.

Step-by-Step: How to File FSSAI Annual Return Online (Form D1)

Here’s how you can file FSSAI annual return online step-by-step in 2025:

- Visit the official FoSCoS Portal → https://foscos.fssai.gov.in/

- Login using your registered FSSAI license credentials.

- Go to “Return” → “Annual Return (Form D1)”.

- Enter business details, including food categories, quantities, and import/export data.

- Upload necessary documents, such as product lists and sales records.

- Verify and submit your return through the FSSAI online compliance filing system.

- Download acknowledgment for your records.

Dairy businesses must follow the same process under the “Half-Yearly Return (Form D2)” tab.

Why Choose MyFoodExpert for FSSAI Return Filing

Filing your FSSAI annual returns may appear straightforward, but even a small error in product details, quantities, or categorization can lead to serious compliance issues. MyFoodExpert’s FSSAI compliance professionals ensure your Form D1 and D2 are prepared accurately, reviewed thoroughly, and submitted on time through the official FSSAI online portal.

Our experts handle the entire process — from data verification to final acknowledgment — so your business remains fully compliant and penalty-free.

File your FSSAI returns with MyFoodExpert today to save time, avoid delays, and maintain complete regulatory confidence.

FSSAI Form D1 and D2 Due date

FSSAI Form D1 & D2 Due Date – Annual and Half-Yearly Return Filing Deadlines

The timely filing of the FSSAI Annual Return (Form D1) and Half-Yearly Return (Form D2) is crucial for every Food Business Operator (FBO) in India to maintain full compliance with FSSAI regulations. Missing the due dates can result in penalties, fines, or suspension of your FSSAI license, making awareness of deadlines essential for legal and operational safety.

FSSAI Form D1 Due Date (Annual Return)

- Who Needs to File: FBOs holding a State or Central FSSAI License engaged in manufacturing, processing, or importing food products.

- Due Date: The last date for filing Form D1 FSSAI online for FY 2025–2026 is 31st May 2026.

- Purpose: Reports all food products manufactured, sold, exported, or imported during the financial year, ensuring compliance and transparency.

FSSAI Form D2 Due Date (Half-Yearly Return)

- Who Needs to File: FBOs involved in milk and milk products, including dairy manufacturers, importers, and exporters.

- Due Dates:

- 1st Half-Year (April to September): Submit by 31st October 2025

- 2nd Half-Year (October to March): Submit by 30th April 2026

- Purpose: Tracks milk procurement, production, and distribution, maintaining traceability and adherence to FSSAI dairy regulations.

Importance of Adhering to FSSAI Return Deadlines

- Avoid Penalties & Fines – Late filing attracts monetary fines and potential license suspension.

- Maintain FSSAI License Validity – Timely submission ensures your State or Central FSSAI License remains active.

- Enhance Consumer Trust – Compliance demonstrates transparency, safety, and operational credibility.

- Regulatory Compliance & Inspection Readiness – Properly filed returns streamline audits and government inspections.

Penalties for Non-Compliance with FSSAI Annual & Half-Yearly Return Filing

Failing to file your annual or half-yearly returns within the prescribed timeline can attract fines under the FSS (Licensing and Registration of Food Businesses) Regulations, 2011.The FSSAI annual return filing penalty is ₹100 per day of delay, which continues until the return is submitted. Non-compliance can also lead to license suspension or cancellation in serious cases.

Non-compliance with FSSAI Annual and Half-Yearly Return Filing can have serious legal and financial consequences for Food Business Operators (FBOs) in India. The Food Safety and Standards Authority of India (FSSAI) strictly monitors adherence to regulations, and failing to file Form D1 or Form D2 on time can lead to heavy penalties, license suspension, or even cancellation.

Key Penalties for Non-Filing or Late Filing of FSSAI Returns

- Monetary Fines

Food businesses that fail to submit FSSAI Annual or Half-Yearly Returns within the prescribed timeline are liable to pay financial penalties as per the Food Safety and Standards Act, 2006. Fines vary based on the severity and frequency of non-compliance. - Suspension of FSSAI License

Repeated failure to file returns can result in the temporary suspension of your FSSAI License, halting your food manufacturing, processing, or distribution operations until compliance is restored. - Cancellation of FSSAI License

In extreme cases, persistent non-compliance can result in the permanent cancellation of the FSSAI License, effectively prohibiting your business from operating legally in India. - Legal Action

FBOs that ignore return filing requirements may face legal proceedings, including prosecution under relevant sections of the Food Safety and Standards Act, 2006, which can damage business credibility and incur additional costs. - Impact on Brand Reputation

Non-compliance reflects poorly on your business, eroding consumer trust, investor confidence, and long-term growth potential.

State-Wise FSSAI Annual Return Filing Help – PAN-India Support by MyFoodExpert

Whether your food business operates in one city or across multiple states, MyFoodExpert offers 100% PAN-India support for FSSAI Annual and Half-Yearly Return Filing (Form D1 & D2).

Our compliance specialists assist manufacturers, importers, distributors, and dairy units in every region — ensuring accurate documentation, timely submissions, and full regulatory compliance under FSSAI guidelines.

Below is a quick overview of our state-wise filing assistance network:

| State / Region | FSSAI Return Filing Support | Specialized Services |

|---|---|---|

| Maharashtra (Mumbai, Pune, Nagpur) | MyFoodExpert filing support available | FSSAI D1/D2 filing, compliance verification, online FoSCoS submission |

| Delhi NCR (Delhi, Gurugram, Noida) | MyFoodExpert filing support available | Annual return filing, importer returns, document assistance |

| Karnataka (Bengaluru, Mysuru, Mangaluru) | MyFoodExpert filing support available | Manufacturer & processor returns, D2 half-yearly dairy filing |

| Gujarat (Ahmedabad, Surat, Vadodara) | MyFoodExpert filing support available | FSSAI Form D1 filing for manufacturers & exporters |

| Tamil Nadu (Chennai, Coimbatore, Madurai) | MyFoodExpert filing support available | FSSAI return filing for food traders, processors, and retailers |

| Uttar Pradesh (Lucknow, Kanpur, Varanasi) | MyFoodExpert filing support available | FoSCoS portal filing assistance, penalty avoidance support |

| West Bengal (Kolkata, Siliguri, Durgapur) | MyFoodExpert filing support available | FSSAI online compliance and return filing consultancy |

| Telangana (Hyderabad, Warangal) | MyFoodExpert filing support available | Annual & half-yearly returns for dairy and food manufacturers |

| Madhya Pradesh (Indore, Bhopal, Gwalior) | MyFoodExpert filing support available | Online FSSAI D1/D2 submission and documentation help |

| Punjab & Haryana (Chandigarh, Ludhiana, Ambala) | MyFoodExpert filing support available | Dairy unit D2 filing, manufacturer D1 returns |

| Kerala (Kochi, Thiruvananthapuram, Kozhikode) | MyFoodExpert filing support available | FSSAI return filing for exporters and food processing units |

| Rajasthan (Jaipur, Udaipur, Jodhpur) | MyFoodExpert filing support available | Annual return filing support for all FBO categories |

| Rest of India | PAN-India online assistance | Remote filing, document review, compliance consultation |

File Your FSSAI Returns Anywhere in India

No matter where your food business is registered, MyFoodExpert’s nationwide network ensures seamless support for FSSAI return filing online — from Form D1 for manufacturers/importers to Form D2 for dairy units.

Stay compliant, avoid penalties, and submit your returns accurately — all from one trusted platform.

File your FSSAI Returns with MyFoodExpert – PAN-India compliance experts at your service

Frequently Asked Questions (FAQ) on FSSAI Annual & Half-Yearly Return Filing in India

1. What is FSSAI Annual Return Filing for Food Businesses?

Answer: FSSAI Annual Return Filing is a mandatory compliance requirement for all licensed Food Business Operators (FBOs) in India. Using Form D1, businesses report all food products manufactured, processed, packaged, distributed, sold, imported, or exported during the financial year. Filing ensures FSSAI compliance India, adherence to food safety standards, and eligibility for FSSAI license renewal.

2. What is FSSAI Half-Yearly Return Filing?

Answer: FSSAI Half-Yearly Return Filing requires FBOs dealing with milk and milk products to submit Form D2 twice a year. This return captures milk procurement, dairy product production, distribution, and export details, ensuring traceability, hygiene compliance, and adherence to FSSAI dairy regulations.

3. Who Needs to File FSSAI Annual and Half-Yearly Returns?

Return Type | Who Must File | Business Type | Notes |

Form D1 – Annual Return | All FBOs with State or Central FSSAI Licenses | Food manufacturers, processors, importers, distributors, packaged food brands, online food delivery businesses | Covers full financial year (April–March) |

Form D2 – Half-Yearly Return | FBOs handling milk and milk products | Dairy businesses, milk producers, milk importers, milk product exporters | Filed twice a year (Apr–Sep & Oct–Mar) |

4. What are the Due Dates for FSSAI Form D1 and Form D2?

Form | Period Covered | Due Date | Notes |

D1 – Annual Return | April–March | 31st December | Mandatory for all licensed FBOs |

D2 – Half-Yearly Return (1st Half) | April–September | 31st October | Required for milk & milk product businesses |

D2 – Half-Yearly Return (2nd Half) | October–March | 30th April | Required for milk & milk product businesses |

5. What Information is Required for FSSAI Form D1?

- FSSAI License Number

- List of food products handled

- Quantity and value of products manufactured, sold, or exported

- Packaging types and materials used

- Sourcing details and supplier information

- Distribution and retail channels

- Authorized signatory details

6. What Information is Required for FSSAI Form D2?

- Milk and milk product details

- Quantity procured, produced, and sold

- Source of milk procurement

- Distribution and export details

- Sales invoices and quality/test reports

7. What Documents Are Needed to File FSSAI Annual and Half-Yearly Returns?

Document Checklist for FSSAI Returns (Form D1 & D2):

Document | Purpose |

FSSAI License/Registration Certificate | Proof of compliance & eligibility |

Product list with quantity/volume | Required for reporting manufacturing and sales |

Sales invoices and transaction statements | Verification of distribution and sales |

Packaging and storage documentation | Ensures adherence to food safety standards |

Supplier and sourcing records | Transparency in procurement and traceability |

Testing and quality assurance reports | Compliance with FSSAI food quality regulations |

8. What Are the Penalties for Non-Compliance with FSSAI Returns?

- Monetary fines for late filing

- Suspension or cancellation of FSSAI License

- Legal action under the Food Safety and Standards Act, 2006

- Damage to business credibility and loss of consumer trust

9. How Can Filing FSSAI Returns Benefit My Food Business?

- Maintain full FSSAI compliance India

- Build consumer trust and brand credibility

- Avoid penalties and legal action

- Facilitate smooth audits and inspections

- Enable legal domestic and international trade

10. Can Small Food Businesses Avoid FSSAI Return Filing?

Answer: Only FBOs with Basic FSSAI Registration are exempt. All other businesses holding State or Central FSSAI Licenses must file Form D1 and/or D2 to remain compliant and legally operate in India.

11. How Can I File FSSAI Returns Online?

Answer: FSSAI returns can be filed online via the FSSAI Food Licensing and Registration System (FLRS portal). Upload Forms D1 or D2 with supporting documents before the due date. Online filing ensures accuracy, traceability, FSSAI compliance, and avoids penalties or license suspension.

12. How can I file FSSAI annual return online in 2025?

Answer: You can file your FSSAI annual return online in 2025 through the official FoSCoS (Food Safety Compliance System). After logging in with your FSSAI license number and password, navigate to the “Return” section and select Form D1 (for manufacturers, importers, and food processors) or Form D2 (for dairy units). Fill in all required business details such as product categories, quantities handled, and turnover, then upload relevant documents before final submission.

If you face any technical or compliance-related issues, you can consult MyFoodExpert’s FSSAI return filing professionals for guided assistance and accurate submission.

13. What is the last date for FSSAI annual return filing 2025?

The FSSAI return filing last date 2025 for Form D1 (Annual Return) is 31st May 2025 for the financial year 2024–2025.

For dairy units, the FSSAI D2 half-yearly return filing portal accepts submissions twice a year:

- First Half (April–September) – Due by 31st October 2025

- Second Half (October–March) – Due by 30th April 2026

Timely filing ensures your business remains compliant with FSSAI regulations and avoids the FSSAI annual return filing penalty. For hassle-free submission, it’s advisable to use professional FSSAI online compliance filing services like those offered by MyFoodExpert.

14. Who must file Form D1 FSSAI online?

Answer: All food manufacturers, importers, and processors operating under a valid FSSAI license are required to file Form D1 FSSAI online once every financial year. This form captures critical data like the type and quantity of food products handled, turnover, and source/destination details.

Form D1 submission applies to all non-dairy businesses, including packaged food producers, beverage manufacturers, exporters, and importers.

If your business holds a Central or State FSSAI License, filing Form D1 is mandatory. You can file it easily through the FSSAI annual return filing portal or with expert help from MyFoodExpert’s compliance specialists.

15. What is Form D2 in FSSAI return filing?

Answer: Form D2 is a half-yearly return specifically designed for dairy units handling milk and milk products. It must be filed twice a year through the FSSAI D2 half-yearly return filing portal to report data such as milk procurement, production, processing, and sales.

The submission deadlines are:

- April–September – File by 31st October 2025

- October–March – File by 30th April 2026

Accurate D2 filing is crucial for dairy businesses to maintain FSSAI compliance and prevent penalties. MyFoodExpert offers end-to-end D1 & D2 return filing services for dairy units in India, ensuring timely and error-free submission.

16. What are the penalties for late submission of FSSAI returns?

Answer: As per the FSS (Licensing and Registration of Food Businesses) Regulations, 2011, failure to file FSSAI annual or half-yearly returns on time attracts a penalty of ₹100 per day of delay.

Extended non-compliance may result in FSSAI license suspension, cancellation, or even rejection of future license renewals.

To avoid such issues, businesses are encouraged to file FSSAI returns online well before the deadline or seek assistance from MyFoodExpert’s FSSAI license return filing consultants in India for timely submission and compliance monitoring.

17. Can I get expert help with FSSAI D1/D2 filing?

Answer: Yes, you can get expert help from MyFoodExpert’s professional FSSAI compliance consultants, who specialize in D1 and D2 return filing services across India.

Our team ensures your FSSAI annual return filing online is completed accurately — verifying product details, reviewing license data, preparing documentation, and submitting through the FoSCoS portal without errors.

Professional assistance helps eliminate delays, prevent penalties, and ensure 100% FSSAI compliance for manufacturers, importers, and dairy units.

18. Is FSSAI annual return filing mandatory for small food businesses?

Answer: Yes. The FSSAI annual return filing is mandatory for all Food Business Operators (FBOs), irrespective of business size. Whether you run a small-scale food processing unit, retail outlet, or large manufacturing facility, you must file your FSSAI Form D1 or D2 based on your license category.

Even small food businesses and startups with Central or State FSSAI licenses must comply with annual or half-yearly return filing requirements.

MyFoodExpert offers affordable and simplified FSSAI annual return filing help for small businesses, manufacturers, and importers, ensuring effortless compliance and peace of mind.

19. Is Form D1 return filing mandatory for food exporters in India?

Aswer:Yes. All food exporters operating under a Central FSSAI License must file Form D1 annual return every year, even if exports were minimal. Non-compliance may lead to penalties and suspension of FSSAI license for export.

20. Can an FSSAI license be renewed if returns were not filed?

Answer:No. FSSAI license renewal may be rejected if Form D1 or D2 returns are not filed. The FoSCoS portal blocks renewal applications until pending returns are submitted along with late filing penalties.

21. Do online food businesses like cloud kitchens need to file FSSAI returns?

Answer:Yes. Cloud kitchens, online food brands, D2C packaged food sellers, and aggregator-based vendors must file FSSAI returns every year if they hold a State or Central license.

22. What happens if my food business did not operate in the last financial year?

Answer:Even if no food production or sales took place, the FBO must still file a NIL FSSAI annual return online. Not filing NIL return still attracts the same penalty of ₹100 per day.